Ponsse's Financial Statements for 1 January - 31 December 2022

October-December (continuing operations):

- Net sales amounted to EUR 224.6 (173.2) million

- Operating profit totalled EUR 11.7 (9.1) million, equalling 5.2 (5.3) per cent of net sales

January-December (continuing operations):

- Net sales amounted to EUR 755.1 (608.3) million

- Operating profit totalled EUR 46.6 (50.0) million, equalling 6.2 (8.2) per cent of net sales

- Net result was EUR 34.2 (35.2) million

- Earnings per share were EUR 1.22 (1.26)

- Order books stood at EUR 353,7 (312.6) million at the end of period under review

- Cash flow from business operations was EUR -17.9 (102.4) million (continuing and discontinued operations)

- Equity ratio was 55.0 (60.7) per cent at the end of period under review (continuing and discontinued operations)

- Ponsse has classified the sold functions as assets for sale and reported them as discontinued operations. Unless otherwise specified, the figures presented in this financial statements refer to continuing operations. The balance sheet has not been adjusted for the comparison period. The cash flow statement has not been adjusted.

- The Board of Directors´ dividend proposal is EUR 0.60 (0.60) per share

- The company’s euro-denominated operating profit in 2023 is expected to be slightly higher than the operating profit of its continuing operations in 2022 (EUR 46.6 million).

PRESIDENT AND CEO JUHO NUMMELA:

For Ponsse, 2022 started driven by strong order books, and the market situation looked good. In the previous year, Russia had grown into the world’s largest market for cut-to-length forest machines, also being the largest export market for Ponsse. The situation changed dramatically when Russia invaded Ukraine in February. The sanctions imposed by the EU and the withdrawal of western companies quickly froze Russia’s forest machine market. The war had an extensive impact on Ponsse’s business operations

All exports of forest machines and their spare parts to Russia and Belarus were stopped immediately at the beginning of March. The company’s Board of Directors decided to suspend the operations of Ponsse’s Russian subsidiary OOO Ponsse and start the divestment of operations in Russia. Deed of sale regarding the sale of Ponsse’s largest and most profitable subsidiary was signed in June. While the decision was correct and the only possible course of action, it was still painful in many ways. Operations in Russia accounted for a fifth of Ponsse Group’s net sales and a third of its operating profit. In the end, the company’s order flow was relatively good during the year at roughly EUR 796 million.

During the final quarter of the year, the forest machine market calmed down slightly, while our order flow was roughly EUR 213 million despite the situation. As the availability of parts improved, the factory caught up with its schedules, and we were able to effectively deliver machines to our customers. Our net sales were EUR 224.6 million, driven by the delivery of new machines and the good situation in maintenance. Our customers were very well employed throughout the year.

During the final quarter, the difficulties experienced by Ponsse’s subsidiary Ponsse Latin America Ltda in Brazil escalated quickly. Ponsse Latin America Ltda is responsible for extensive full service agreements. Regarding one full service agreement, the operational challenges resulted in a situation where the company was forced to recognise write-downs and prepare for the current year’s challenges. As a result, Ponsse’s net sales for the final quarter remained at EUR 11.7 million.

Ponsse’s performance was relatively good given the extremely difficult global situation, and we were able to offset the loss of the Russian subsidiary in our net sales. During the year, our net sales were roughly EUR 755 million, and our maintenance services and technology company Epec showed excellent growth. However, we were unable to adjust our profitability as quickly. The suspended operations in Russia, the problems with the availability of parts and components, dramatic inflation rates, and the challenges experienced by our subsidiary Ponsse Latin America Ltda in Brazil reduced the company’s profitability and cash flows.

During the year, the problems with the availability of parts and components often escalated unexpectedly which was reflected in an increase in the Vieremä factory’s inventory values and in stocks of nearly finished forest machines. In contrast, our used machine stocks made relatively good progress throughout the year. Our cash flow from business operations was EUR -17.9 million.

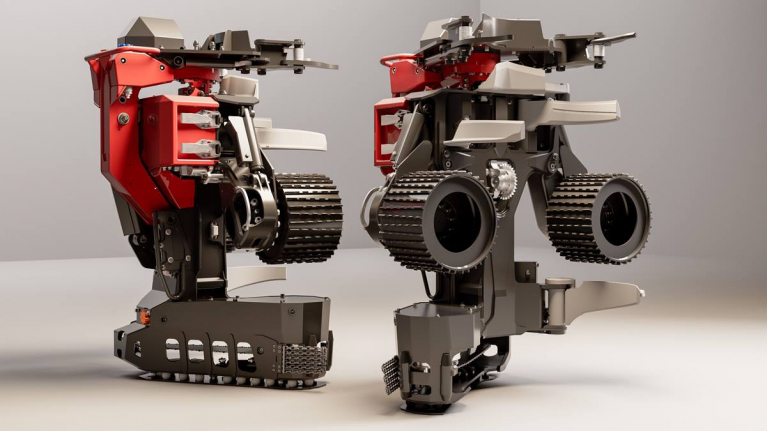

In 2022, we launched new products and services at a quick pace. The most significant launches were PONSSE Mammoth, the latest addition to our forwarder range with its 25-tonne capacity, PONSSE Scorpion Giant, our new harvester model, the PONSSE H8 harvester head, and a large number of new maintenance service solutions. Our new product features seek to make operators’ work easier and improve ergonomics. These included the cabin suspension system PONSSE Active Cabin, the rotating PONSSE Active Seat, and the PONSSE Manager Satellite, which enables satellite connections in forest machines. We also took our first step towards electric forest machines. The fully electric powertrain of PONSSE EV1, a technological forwarder concept, has been developed with our technology company Epec. The solution is a strong indication of our direction and role as part of fossil-free forestry.